PPSA projects revenues of US$ 157 billion just from the sale of Union oil over the next ten years

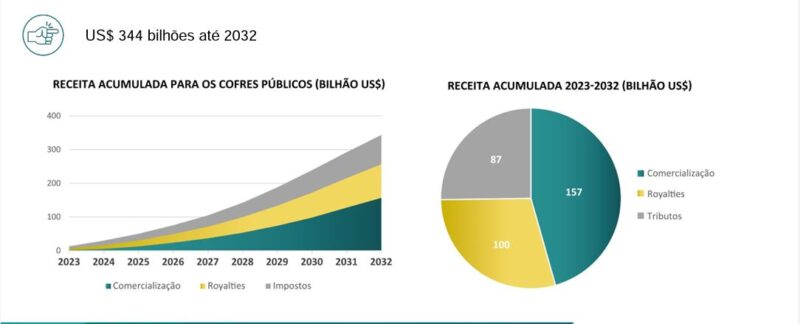

Production sharing contracts will contribute around US$344 billion to public coffers over the next ten years. The projection is from the study “Estimating results in production sharing contracts”, prepared by Pré-Sal Petróleo (PPSA) and released this Tuesday (29), by the company’s CEO, Eduardo Gerk, at the 5th Pre-Salt Oil Technical Forum. Most of this amount will come from the sale of oil that the Union is entitled to in contracts until 2032, which, according to the study, will generate revenues of US$ 157 billion. The other resources will come from royalties’ payments (US$ 100 billion) and taxes collected by the producing companies, totaling another R$ 87 billion.

According to the study, average oil production under a production sharing regime will rise from the current 668,000 barrels per day (bpd) to approximately 2 million bpd in 2027 and reach 2.9 million bpd in 2030, which will represent more than half of the national oil production and about 2/3 of the total produced in the pre-salt that year. If there are no new production sharing contracts, a decline in this volume is expected for the next two years, reaching 2032 with 2.5 million bpd. From 2023 to 2032, contracts will accumulate a total of 7.7 billion barrels produced.

The share of daily production destined for the Union, calculated based on the supply rate of surplus oil by the Union in each contract and the oil cost recovery limit for each area, will also show continuous growth until 2031, with a slight decline in 2032, for the same reasons. The best year will be 2031, when production will reach 920,000 bpd, more than 40 times the volume of average daily production in the Union in 2022 (22,000 bpd on average from January to September). The forecast production for the Union in 2031 is comparable to the United Kingdom current production and superior to that of countries such as Colombia, Argentina and Venezuela.

“The study shows that, in ten years, the Union will have accumulated 1.9 billion barrels of oil. This entire amount will be traded by PPSA. We are preparing for the company escalation. By the end of this decade, the PPSA will be raising more than US$ 20 billion per year for the public coffers”, explained Gerk.

To develop these contracts, the industry will invest around US$ 72.5 billion over the period studied. The investment peak is expected for the year 2028, when US$ 11.3 billion will be invested. The study estimates that 21 new FPSOs (Floating Production, Storage and Offloading Units) and 319 wells will be required.

Study premises

The PPSA Strategic Planning team carried out the work using an internally developed economic evaluation model. To estimate the future oil price, the Energy Research Office (EPE) reference scenario of October 2022 was used. To project the first oil, the production curves, investments and costs, the existing Development Plans and estimates of the PPSA technical team were used, eventually having a typical pre-salt project as an analogue.

To calculate the investments, the following assumptions were adopted: for FPSOs – units with a capacity of up to 225 thousand barrels/day, considering their investments made in the three years prior and during the first oil; for wells – 1 exploratory well per project and 1 pair of producer/injector wells for every 24,000 barrels of FPSO capacity.

To learn more, download the e-bookEstimating Results in Production Sharing Contracts